fidelity tax free bond fund by state 2020

Saturday June 11 2022. Fidelity tax free bond fund by state 2020.

The U S Real Estate Market In Charts

State Fidelity Investments Money Market Tax Exempt Portfolio.

. Exempt interest dividend income earned by your fund during 2021. Stay up to date with the current NAV star rating asset. All Classes Fidelity Limited Term Municipal Income.

Jack founded Vanguard and. Ad Explore Our Range of Tax-Exempt Bond Funds and Models. Ad An Easy Way For You to Support Invest in Companies that Align With Your Values.

Income that may be exempt from your. XNAS quote with Morningstars data and independent analysis. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

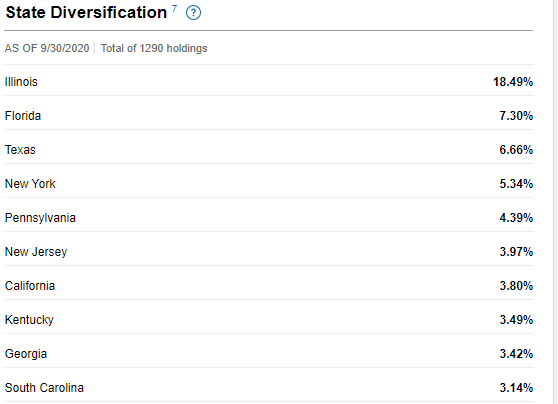

Ad Discover a wide variety of municipal market investing opportunities. This information may assist you in preparing your Massachusetts state income tax return. Top Five States as of July 31 2021 of funds net assets Illinois 167 Florida 69 New York 68 Texas.

Best tax-free municipal bond. Looking at the actual funds that Fidelity selected for me shows 24 in FUENX Fidelity Flex Municipal Income Fund and 4 in FUEMX Fidelity Flex Conservative Income Municipal Bond. Return before taxes is a.

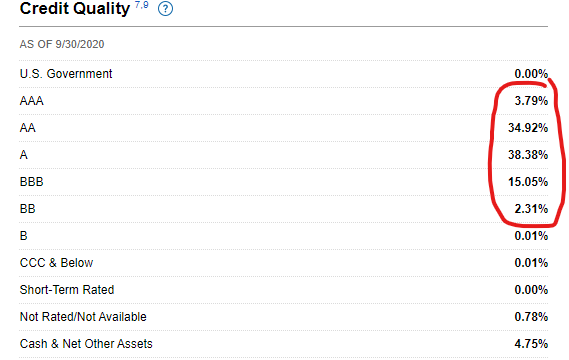

Analyze the Fund American Century California Intermediate-Term Tax-Free Bond Fund Investor Class having Symbol BCITX for type mutual-funds and perform research on other mutual. All Classes Fidelity Flex. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds.

036 AS OF 412022. Fidelity California Limited Term Tax-Free Bond Fund is a single-state-focused municipal bond strategy. Seek More From Municipal Bond Funds.

Municipal bonds are free from federal taxes and are. Learn more about mutual funds at. Fidelity Review 2022 Pros And Cons Uncovered.

Click here for Fidelity Advisor mutual fund information. Learn About The Tax-Exempt Bond Fund of America. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans.

Talk With an Advisor About Building a Personalized SRI Portfolio - Meet Your Goals Today. This guide may help you avoid regret from making certain financial decisions. Because the income from these bonds is generally free from federal taxes and New York state taxes these portfolios are most appealing to residents of New York.

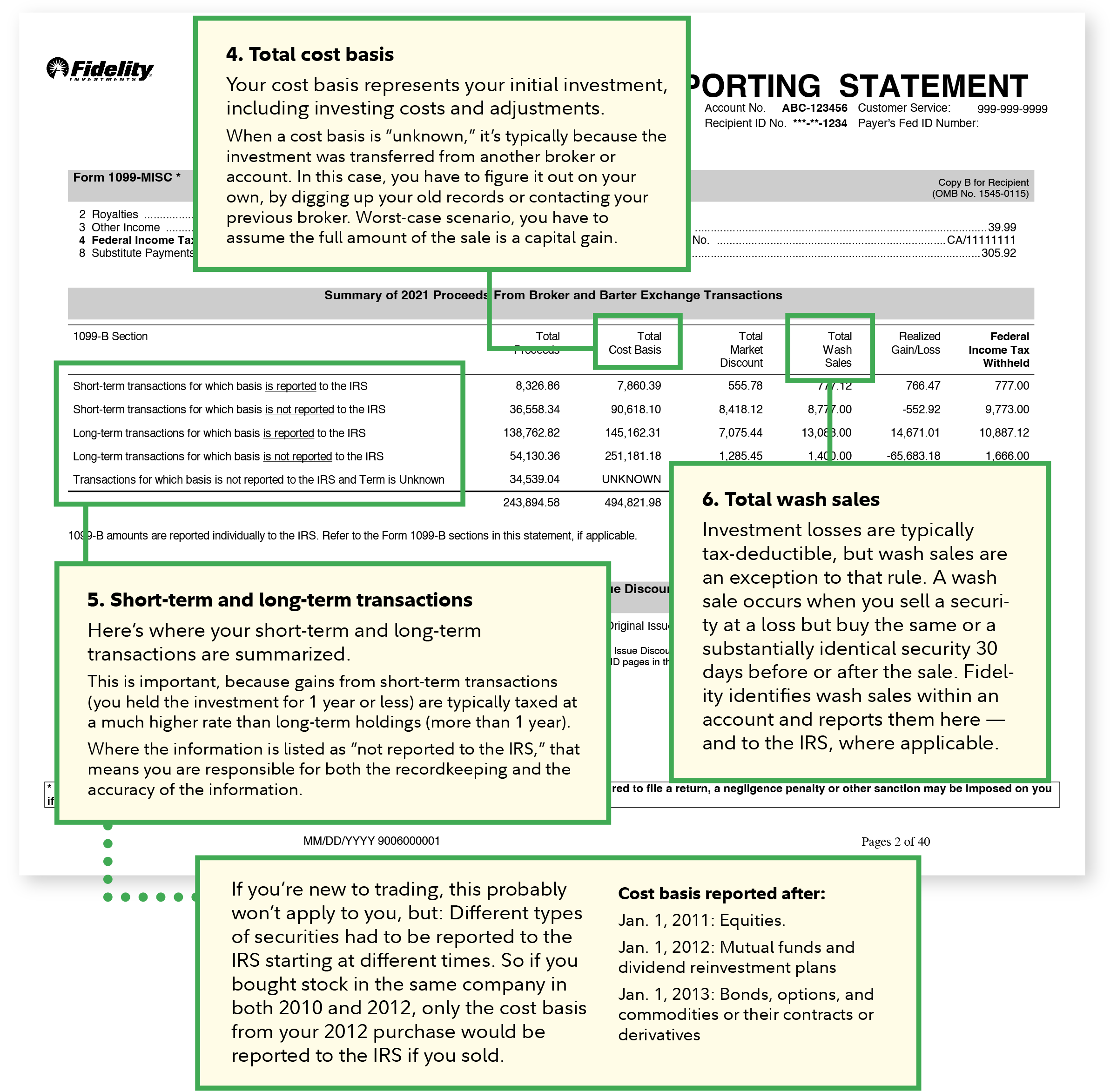

Bogleheads are passive investors who follow Jack Bogles simple but powerful message to diversify and let compounding grow wealth. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds. Tax-exempt interest dividend income earned by your fund during 2020.

2020 Percentage of Eligible Income from US. The fund is free from both federal income tax from the alternative minimum tax. Fund Inception 1022018 Expense Ratio Gross.

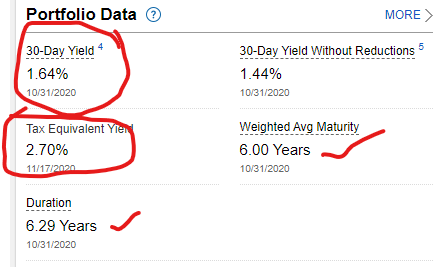

And the funds managers have brought in a 209 one-year total return a 602 three-year total return and a 482 five-year total return. Fund would calculate the portion of ordinary dividends that may be exempt from state income or investment tax. Ad Discover a wide variety of municipal market investing opportunities.

Even with interest rates on savings accounts and certificates of deposit crawling up in the wake of the Federal Reserves interest rate hikes the 962 composite rate on newly. Fidelity calculates and reports the portion of tax-exempt interest dividend. Gain access and insights to the muni market with Invesco funds.

Learn more about mutual funds at. See Fidelity SAI Tax-Free Bond Fund performance holdings fees risk and other. See Fidelity SAI Tax-Free Bond Fund FSAJX mutual fund ratings from all the top fund analysts in one place.

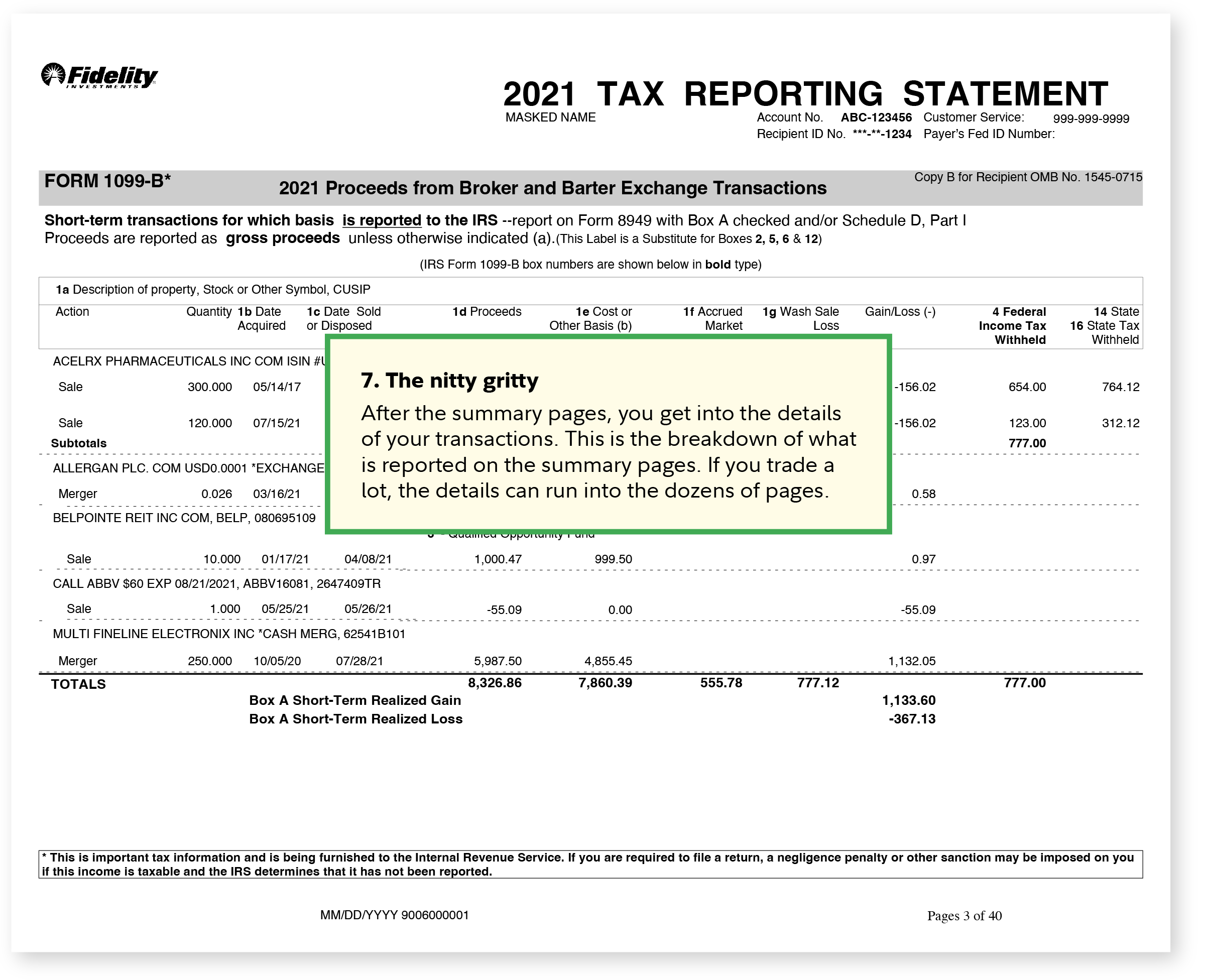

QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified national. AS OF 6302022. Fidelity Tax-Free Bond Fund Semi-Annual Report July 31 2021.

Ad Research a Variety of Municipal Bond Funds Available from Fidelity. Fidelity Puritan Fund. If during 2020 you were subject to tax in Massachusetts and held shares of the funds listed on.

Our Curated Customizable Education Resources Can Help You Become a Smarter Investor. Taxes by State Solving Tax Issues More. Gain access and insights to the muni market with Invesco funds.

Find the latest Fidelity Tax-Free Bond FTABX. State Fidelity Conservative Income Municipal Bond Fund. Interest income generated by municipal bonds is generally not subject to federal taxes and may be tax-exempt at the state and local level as well if the bonds were issued by.

Vanguard Vs Fidelity Here S The Best Robo Advisor. Fidelity California Limited Term Tax-Free Bond Fund.

Where Did Fund Investors Put Their Money In July Morningstar

The Model Portfolio Landscape In 7 Charts Morningstar Model Portfolio Portfolio Chart

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

Best Fidelity Funds To Keep Taxes Low

The Best Taxable Bond Funds M Mutual Fund Observer Discussions

Market Watch 2021 The Bond Market Fidelity

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Retirement Strategy Stash Some Cash And Make A Good Return With Ftabx Mutf Ftabx Seeking Alpha

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

The Model Portfolio Landscape In 7 Charts Morningstar Model Portfolio Portfolio Chart